Understand Every Move.

Uncover the Value.

Make Decisions with Speed.

Instant LBO Analysis brings private equity modeling into the modern age. Whether you are screening a new opportunity or preparing for a full investment committee review, our system gives you fast, robust leverage buyout analysis at the click of a button.

Live Financial Analysis

Real-time modeling results and comprehensive deal analysis powered by advanced algorithms

Complete Private Equity Platform

Everything you need for fast, robust LBO analysis in one intelligent platform

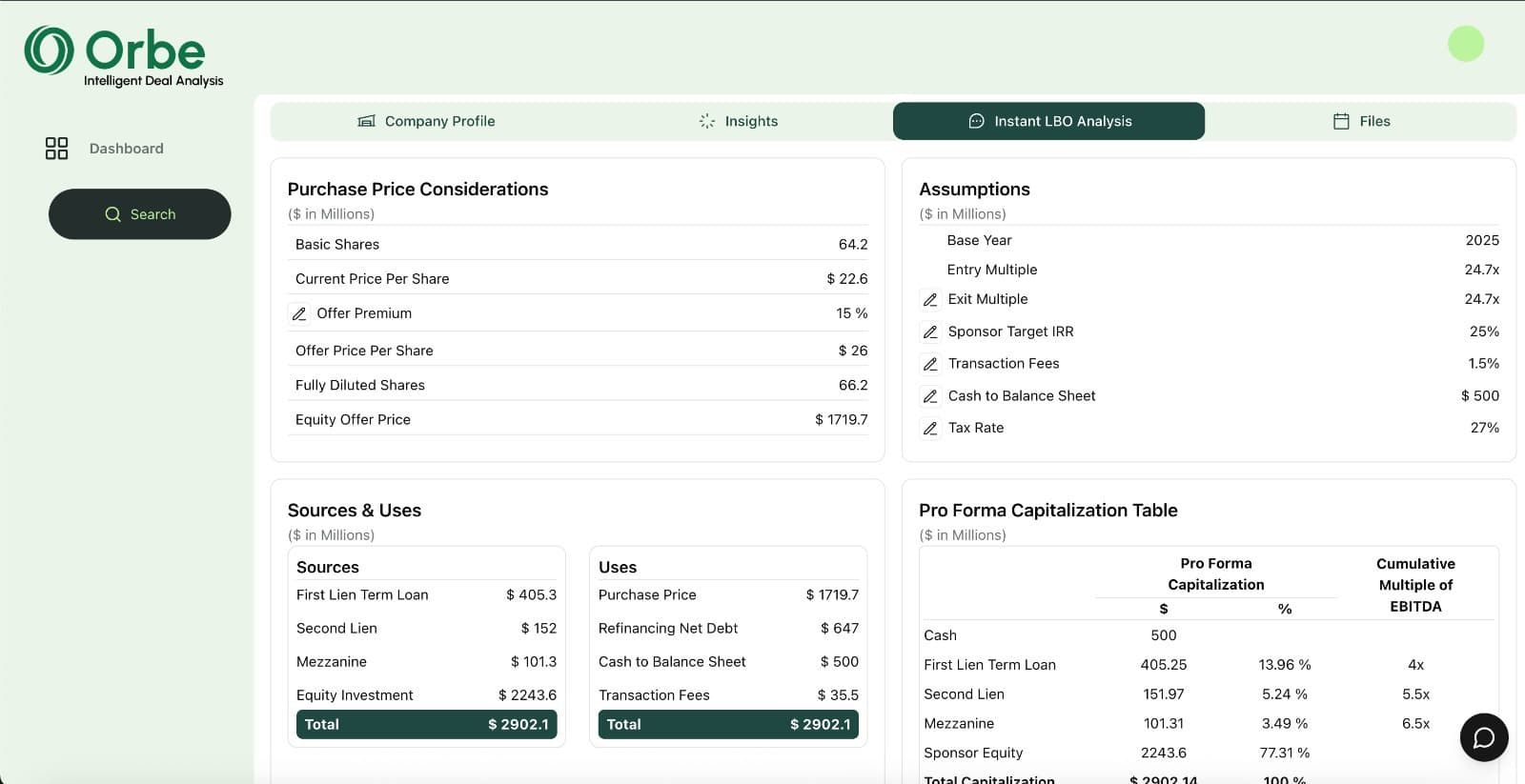

Upload your financials and deal terms. The platform quickly builds a full LBO model, showing how capital moves through the deal—from equity checks and lender commitments to exit scenarios and distributions.

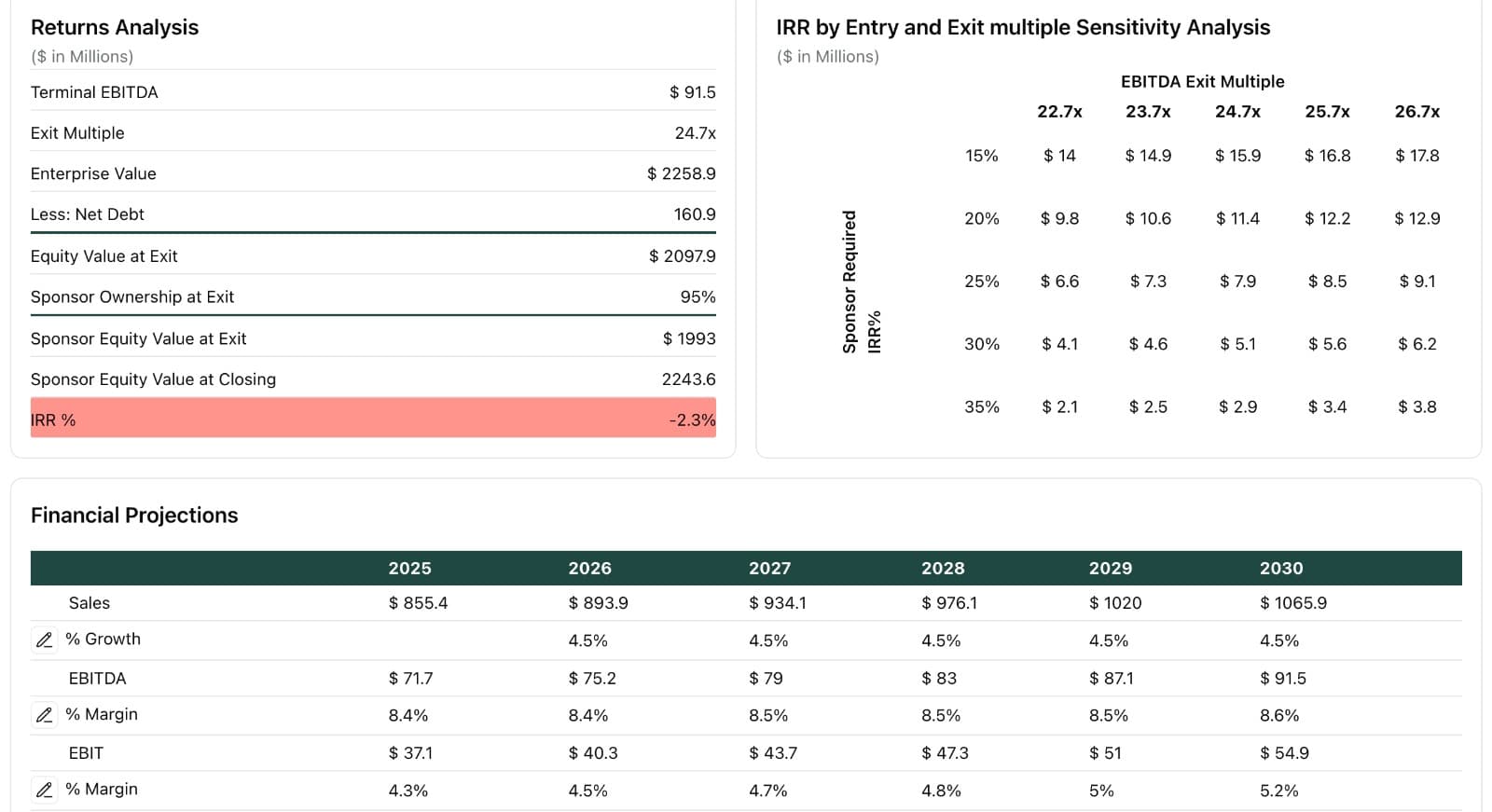

Get immediate visibility into projected IRR, equity multiples, and year-by-year cash yield. Explore base, upside, and downside cases without endless Excel rework.

Understand key drivers and stress points with instant sensitivity analysis. Test the impact of leverage, delayed exits, or changing valuations with real-time feedback.

See exactly how value builds for each layer—equity, preferred, management, and debt. The platform shows waterfall outcomes and where incentives align.

Why Choose Instant LBO Analysis?

Model any deal—large or small—in seconds

Always see the 'so what' for cash, risk, and returns

Move from screening to deep dive without manual effort

Make conversations with your team grounded and efficient

The Bottom Line

Instant LBO Analysis lets you cut through complexity and get straight to the truth of the deal. Model returns, check capital structure, spot vulnerabilities, and present results with total confidence—no spreadsheets required, no detail missed.